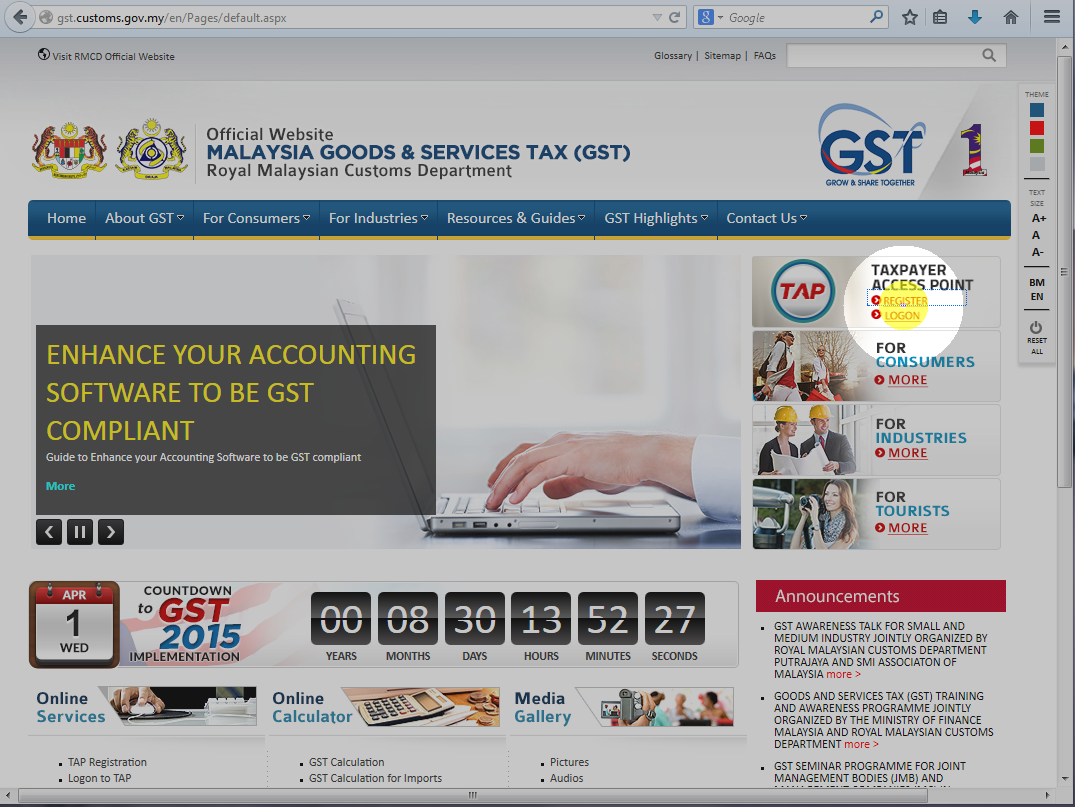

GST Malaysia - The History of GST in Malaysia

In the months followed by Budget 2013, there have been hot debates

and discussions in the market about the long proposed GST (Goods and

Services Tax) to be implemented by April 2015. The breathing period is

the best time for businesses to get ready before the commencement.

In fact, GST was first announced dated back in the 2005 Budget for

implementation in 2007, but the federal government halted the action as

more time was needed to get feedback from the general public. It was

then again tabled for first reading in year 2009 for proposed

implementation in 2011, but was withdrawn for unknown reasons.

Finally on October 2013, Malaysian Prime Minister Datuk Seri Najib

Razak announced the introduction of GST to replace the service tax which

will be effective on April, 2015. With the successful implementation of

GST, Malaysia will join the majority of ASEAN countries which are

already embracing the GST taxation system.

What is GST Malaysia?

For the common folks that have the least idea on what GST is, it is a

multi-stage taxation system on goods and services in each point of

supply chain from the manufacturer to the retailer. The basic

fundamental of GST Malaysia is the feature that allows businesses to

claim their input tax credit back from the government in their

accounting system.

Goods and Services Tax

(GST) is a multi-stage consumption tax on goods and services whereby

each point of supply in a production chain is potentially taxable up to

the retail stage of distribution. At the same time suppliers are

entitled to refunds of GST incurred on business inputs. The basic

fundamental of

GST Malaysia is its self-policing

features which allow the businesses to claim their Input tax credit by

way of automatic deduction in their accounting system. GST in Malaysia

will replace the existing taxation system (SST), to be part of the

government’s tax reform program.

Proposed Rate of GST in Malaysia

Back then GST was proposed at a rate of 4% in year 2009; however it

might be higher at this point of time after years of delay. There are 3

types of supply for GST Malaysia:

i. Standard rated

Standard-rated supplies are goods and services that are charged GST

with a standard rate. GST is collected by the businesses and paid to the

government. They can recover credit back on their inputs. If their

input tax is bigger than their output tax, they can recover back the

difference.

ii. Zero rated

These are taxable supplies that are subject to a zero rate.

Businesses are eligible to claim input tax credit in acquiring these

supplies, and charge GST at zero rate to the consumer.

iii.Exempt

These are non-taxable supplies that are not subject to Malaysia GST.

Businesses are not eligible to claim input tax credit in acquiring these

supplies, and cannot charge output tax to the consumer.

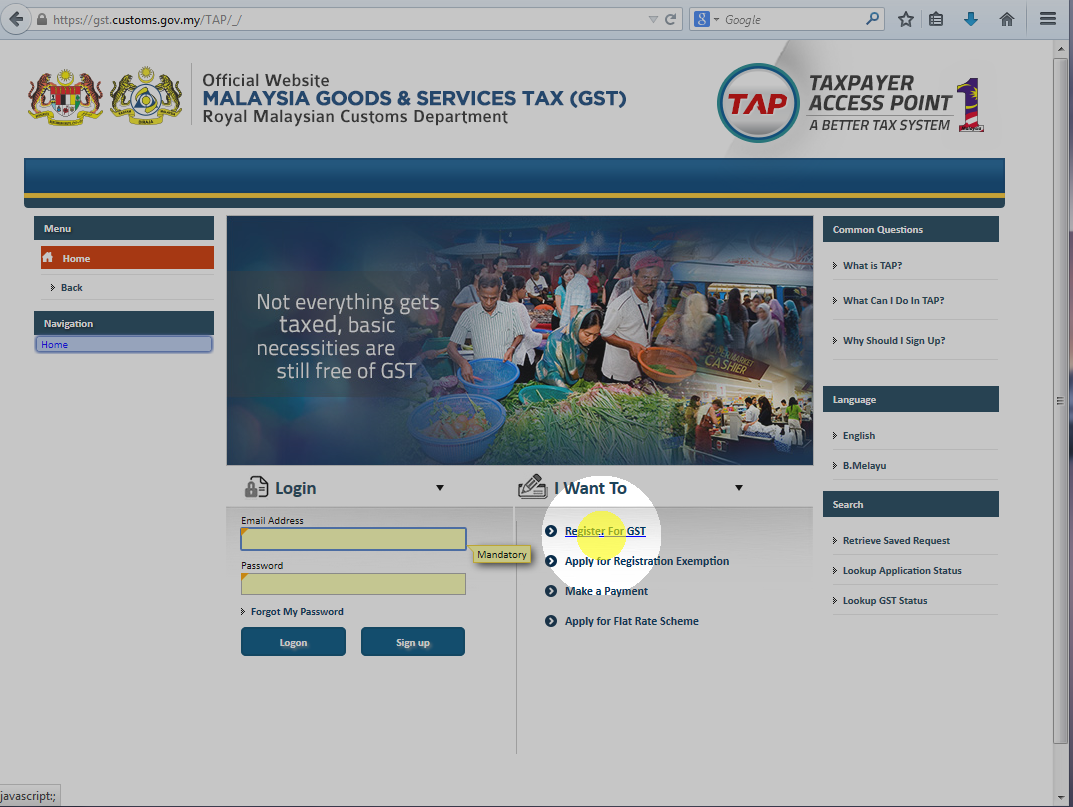

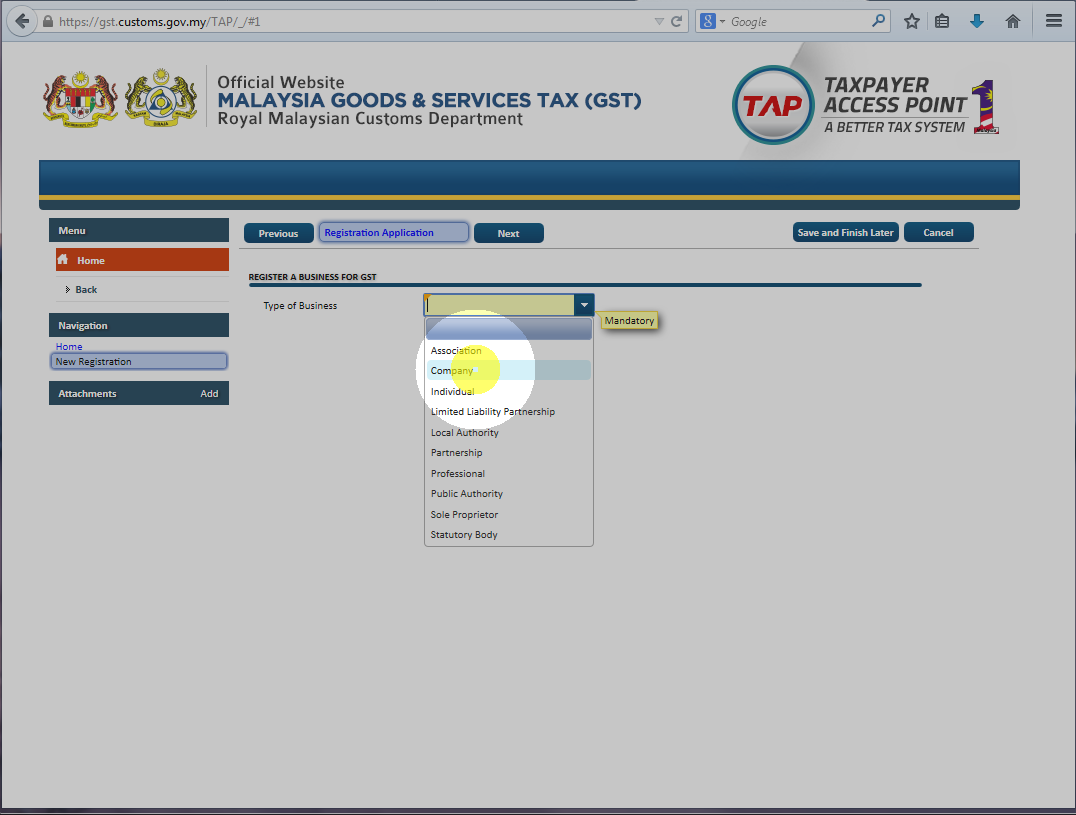

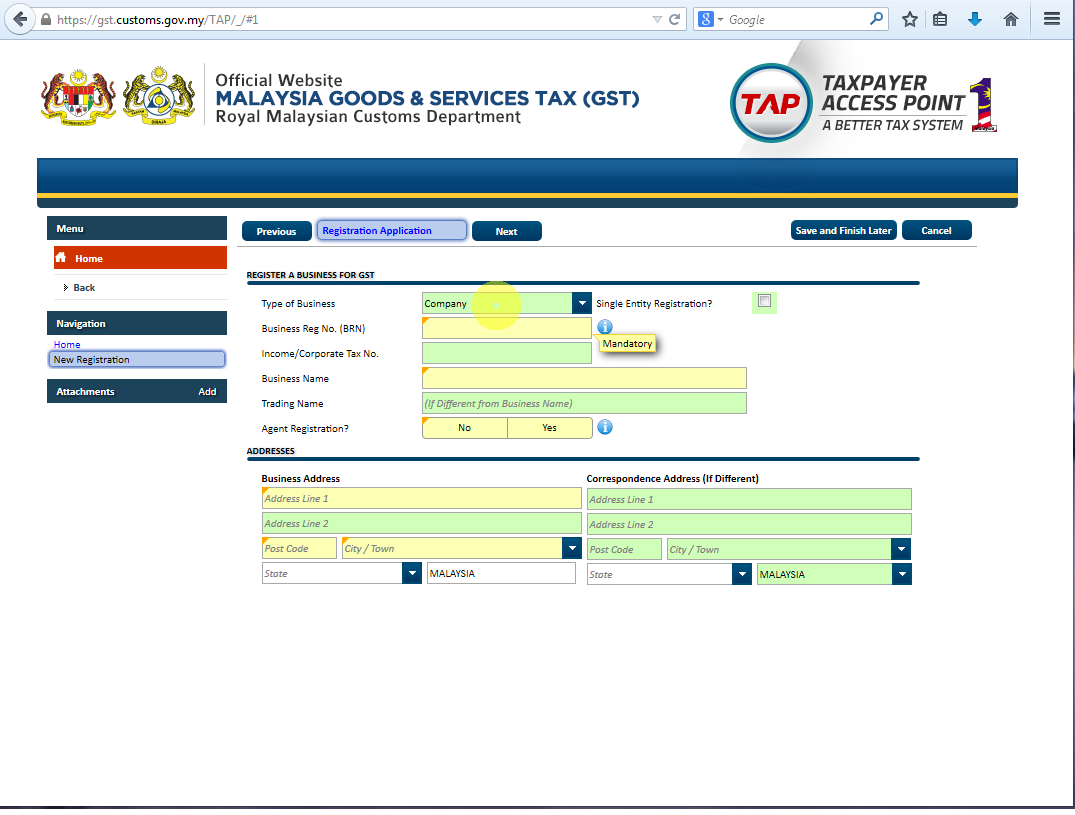

Why should businesses comply and register for GST?

1. GST may lower Malaysia's business costs because input tax paid can be claimed back. Previously these costs may be included in expenses and increase the cost of doing business. If your business costs have reduced, you have two choices. You can do nothing or make adjustments to your prices.

- Please note that if your business costs have been lowered due to GST,

you are expected todo adjust your prices accordingly otherwise you

could be charged under the Price Control and Anti-Profiteering Act 2011.

- If you do not reduce your prices, it does not mean your direct

competitor will not. So you may start losing business to a competitor

who has done his homework on GST.

2. If you supply to larger businesses who are GST registered, you may

be required to register voluntarily for GST in order to continue

supplying to these customers. Otherwise they may not want to purchase

from you as they cannot claim for input tax because your invoices are

not GST compliant or proper tax invoices.

3. Even if your annual revenue is less than RM 500,000, your business

will benefit if you register voluntarily. Consider this: If your

annual business costs is RM 300,000 you will likely be paying 6% GST on

most of that amount. You are paying RM 18,000 GST per year to your

suppliers. If you are GST registered, you get to claim this 18,000 back

every year. Of course, you can decide to absorb the extra 18,000 cost in

your business. It just means that you will get RM 18,000 less profit or

you have the option to increase your prices. However, if you increase

your prices, you may lose sales to your competitors who are GST

registered and have lower cost, and therefore their selling price will

be lower.

4. Business owners should be aware of the penalties for not complying with GST.

- Late Payment from 5% to 25% of GST can be payable.

- Incorrect return/understate output tax/overstate input tax – upon

conviction, RM 50,000 fine or 3 years imprisonment plus penalty equal to

the amount of tax undercharged. Offence can be compounded by paying

50%.

- General Penalty – upon conviction, RM 30,000 fine or 2 years imprisonment. Compound is 50%.

- Directors are severally and jointly responsible for GST compliance of the business.

Proposed change to Finance Act 2013, now means that any person who

controls directly (or indirectly through the medium of other companies)

not less than 20% of the ordinary share of the company, is considered a

director (previous threshold was more than 50%).

5. If your business is not GST registered, then you are in fact

announcing to all your business associates and extended family that your

business has an annual revenue of less than RM500,000. In a ‘kiasu’

environment, how shameful will this be if there is no change in GST

status from one year to the next!

Furthermore, your customers may feel more comfortable to purchase

goods and services from a ‘larger’ company because of reasons such as

business stability, more staff, etc.

If you need to be GST registered, whether for business or ‘face’ reasons, you should do it properly.

GST – How will it impact Home & Property Market?

The implementation of GST (Goods & Services Tax) is inevitable,

and is planned to roll out in April 2015. The majority will be concerned

with the effect brought by the new implementation, and with no doubt

this will have effects to the home and property market. In the following

context we will be discussing on how the stated market will be affected

moving forward. We of course assume that reader already have basic

knowledge on the workings of GST before proceeding. Also it would be a

plus if readers have an understanding of the existing Sales and Service

Tax for better comparison.

GST – Similarities of Tax Schemes of Residential Property

One of the largest similarities between GST

and SST is that there would be no charges to the consumers on the

purchase of any home/residential properties because it falls under the

“exempt rated” category. However, GST will be charged on purchases of

commercial property because these will be categorized in “Standard

Rated”.

Under both schemes, developers would incur taxes during

procurement stages for inputs of raw materials. This is also where

differences start to become apparent between both taxation systems. The

tax rate for the materials varies between GST and SST.

GST – The differences against Sales Tax for Residential Properties

Based on the Sales Tax of 1972, basic construction materials like

bricks, cements, floor tiles, aluminum frames etc fall into First

Schedule Goods, in which everything in this category will not be

subjected to sales tax. In the meantime, other building materials that

falls outside of the first scheduled goods are subjected to a sales tax

of 5%.

In comparison, all building materials and services (that includes

contractors, engineers, architects etc.) will be subjected to a GST of

6%. This will definitely increase the production costs for developers.

GST works in a way where additional tax costs will be passed down to the

consumers, or to be claimed back from the government. But in cases like

properties (exempt-rated), the developers will be responsible in

bearing the additional tax costs. On paper this should be the perfect

news for property buyers as they do not have to worry about the

additional GST taxation, but it is also inevitable that developers will

try to build in the additional tax costs into the final sales price.

GST – Final advices before a property purchase

SO as a home buyer, you should have sufficient knowledge over the

effects after the implementation of GST. Here are some key insights

before we put an end to this article:

- There will be a once-off increase in property prices with GST.

- The overall price increase for new residential properties

would be lower in comparison with new commercial properties.

- The second hand home market will be affected after GST.

With knowledge, it is always easier to gauge the value of the property and make better decisions.